Converting 401k to roth ira calculator

Thinking youre not around to retire next year you desire growth and concentrated investments for your Roth IRA. Compare 2022s Best Gold IRAs from Top Providers.

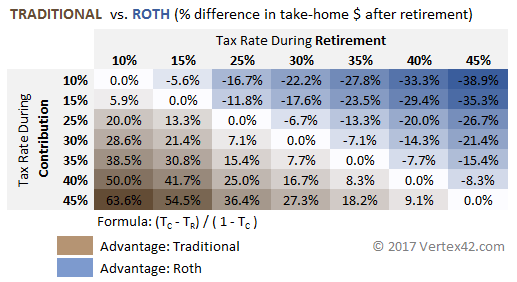

Traditional Vs Roth Ira Calculator

There are many factors to consider including the amount to convert current tax rate and your age.

. Convert 401k To Roth IRA Calculator. The Roth IRA conversion and designated Roth 401k conversion media storm is in full swing. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA.

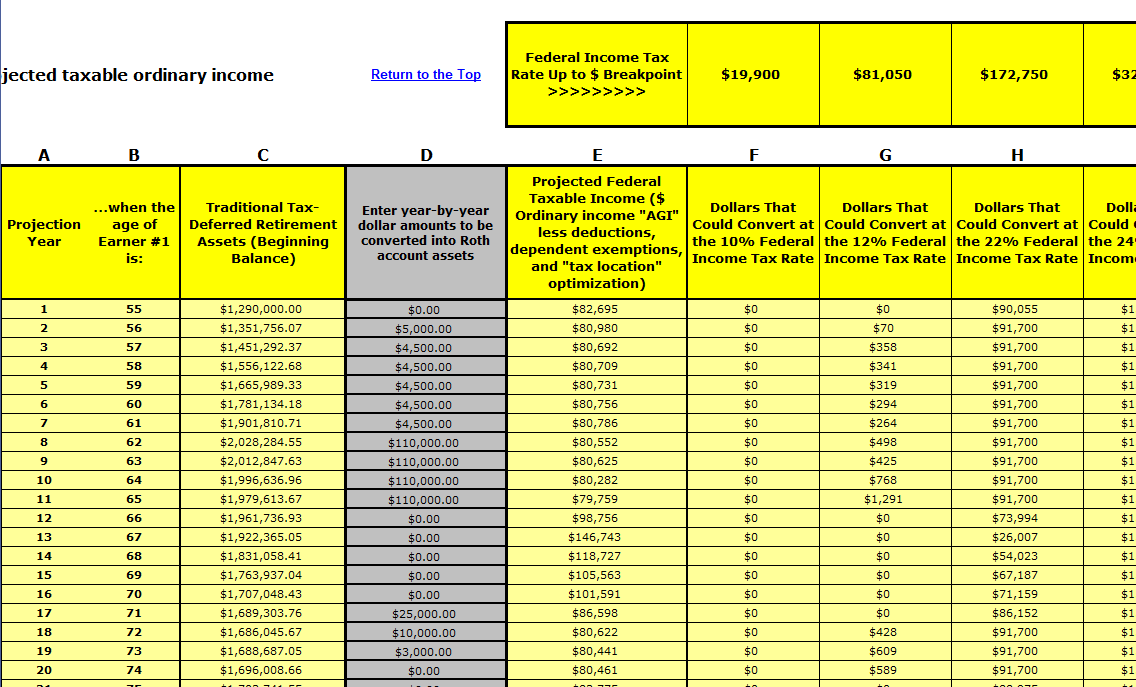

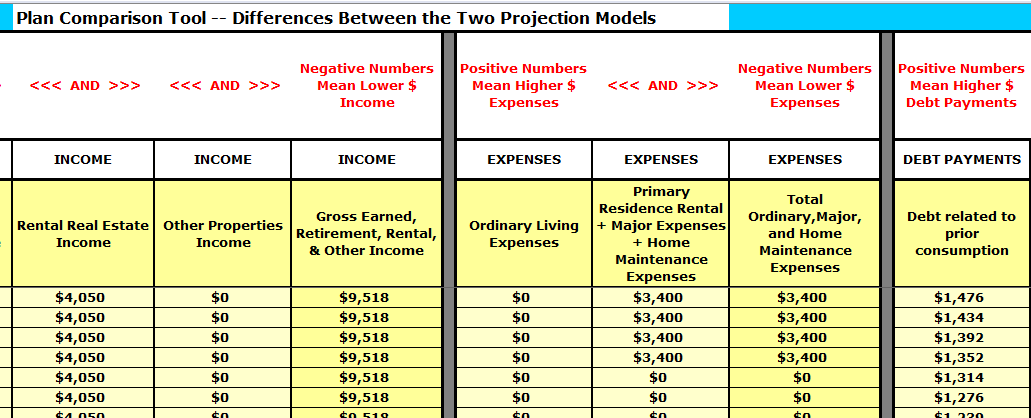

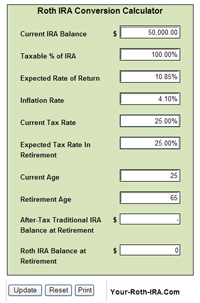

Roth IRA Conversion Calculator Use this Roth IRA conversion calculator to project the inflation-adjusted after-tax value of your Traditional IRA or 401k at retirement versus the inflation. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. Roth Conversion Calculator Methodology General Context.

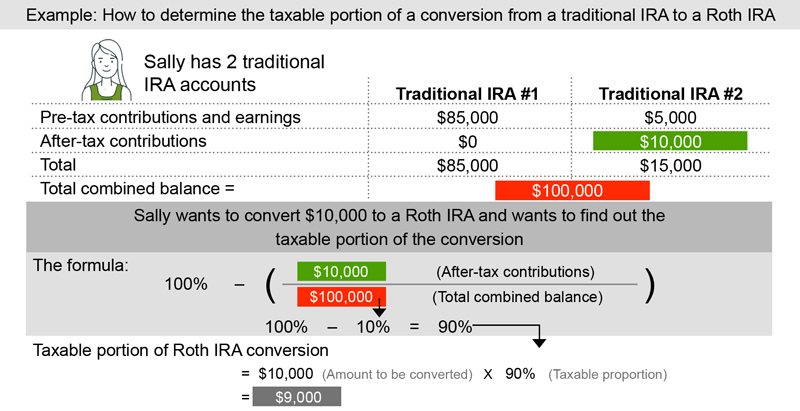

A Roth IRA conversion is a tool that allows individuals to convert money from a tax-deferred retirement account like a traditional IRA or 401k into a Roth IRA. Roth Conversion Calculator Methodology General Context. For some converting traditional retirement account assets into Roth accounts can.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Once converted Roth IRA plans are not subject to required minimum distributions RMD. When planning for retirement there are a number of key decisions to make.

As of January 2006 there is a new type of 401 k -- the Roth 401 k. Make a Thoughtful Decision For Your Retirement. The information in this tool includes education to help you determine if converting your.

Ad Open an IRA Explore Roth vs. Ad Secure Your Financial Future. Because you pay the conversion tax in advance you also eliminate the income tax your current heirs would in any other case have to pay out on withdrawals.

A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan such as a 401 or a traditional IRA to a Roth IRA. The Roth 401 k allows contributions. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Find a Dedicated Financial Advisor Now. Converted plan balance is allowed to grow tax-free and all withdrawals are tax-free as well. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Converting to a Roth IRA may ultimately help you save money on income taxes. Roth IRA conversion with distributions calculator. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Calculate your earnings and more. Roth IRAs arent tax. Ad Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals.

Reviews Trusted by Over 45000000. Allows talk about the three methods. Your IRA could decrease 2138 with a Roth.

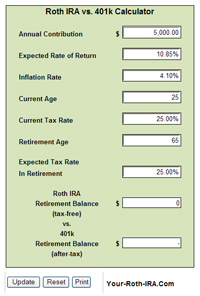

Roth IRA conversion calculator. Roth IRA is a great way for clients to create tax-free income from their retirement assets. Secure Your Future Retirement with Gold Silver Investments.

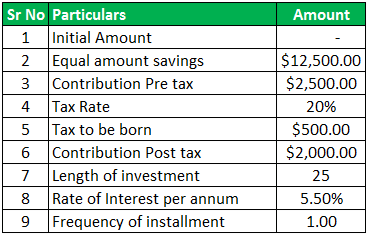

This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. Learn More About American Funds Objective-Based Approach to Investing. A 401 k can be an effective retirement tool.

Use this calculator to see how converting your traditional IRA to a Roth IRA could affect your net worth at retirement. Do Your Investments Align with Your Goals. Bankrate provides a calculator to help you make decisions on converting traditional IRA funds to a Roth IRA individual retirement account.

For instance if you expect your income level to be lower in a particular year but increase again in later years. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will. This calculator will show the advantage.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Traditional or Rollover Your 401k Today.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Rollover Your IRA401k Into Precious Metals Investments.

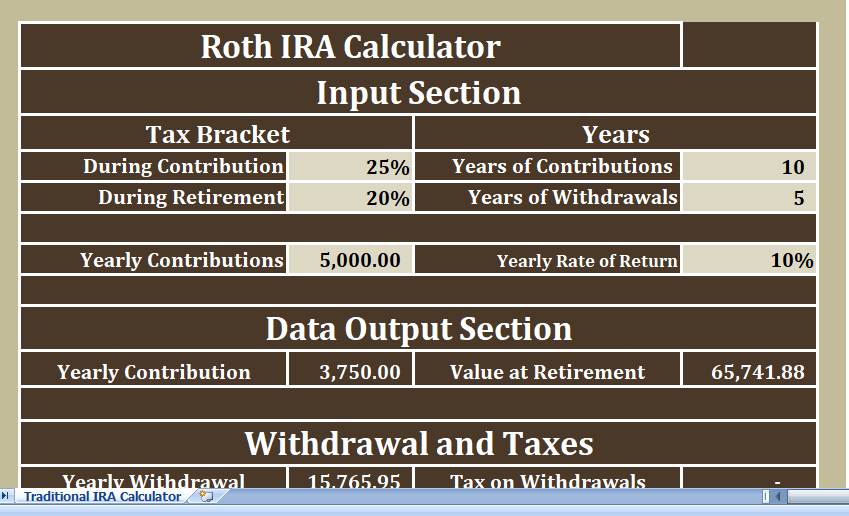

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

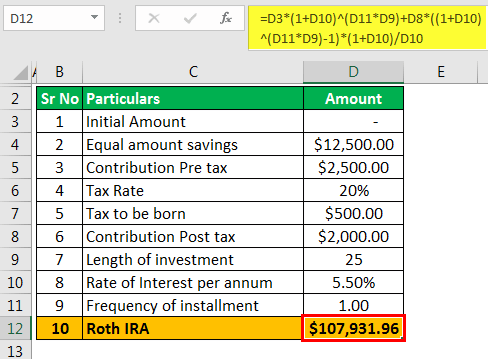

Roth Ira Conversion Calculator Excel

Roth Ira Calculator Roth Ira Contribution

Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Conversion Tax Calculator Software

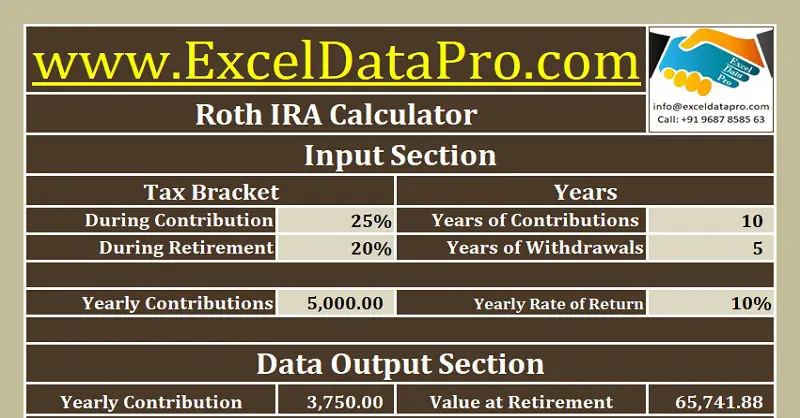

Download Roth Ira Calculator Excel Template Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculators

Roth Ira Calculator Excel Template For Free

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

Roth Conversion Q A Fidelity